IRS CP565 2017-2025 free printable template

Show details

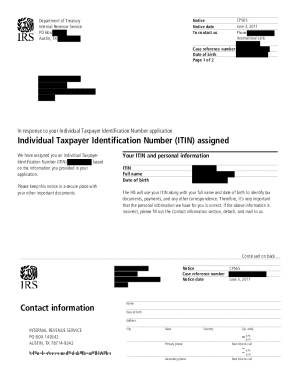

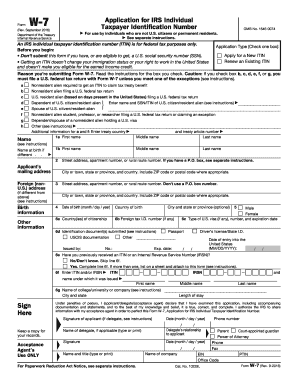

Notice Notice date To contact us Department of the Treasury Internal Revenue Service PO BOX 149342 Austin TX 78714-9342 Case reference number Date of birth Page 1 of 2 CP565 January 26 2017 Phone 1-800-908-9982 International calls Phone 267-941-1000 99999 January 20 1990 JOHN SMITH 123 N HARRIS ST HARVARD TX 12345 Confirmation of your Individual Taxpayer Identification Number We renewed your Individual Taxpayer Identification Number ITIN NNN-NN-NNNN This notice confirms your assigned ITIN...

pdfFiller is not affiliated with IRS

Understanding and Navigating IRS CP565

Detailed Steps for Editing IRS CP565

Guidelines for Completing IRS CP565

Understanding and Navigating IRS CP565

IRS CP565 is a crucial document for taxpayers that helps in accurately reporting specific financial events to the Internal Revenue Service (IRS). This form is particularly essential for individuals and businesses that find themselves in unique scenarios regarding taxes. Grasping the nuances of IRS CP565 will empower you to manage your tax responsibilities effectively and avoid potential penalties.

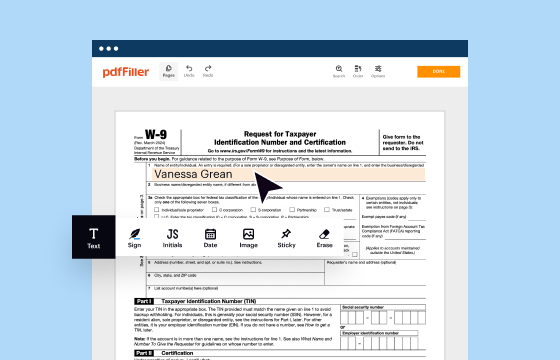

Detailed Steps for Editing IRS CP565

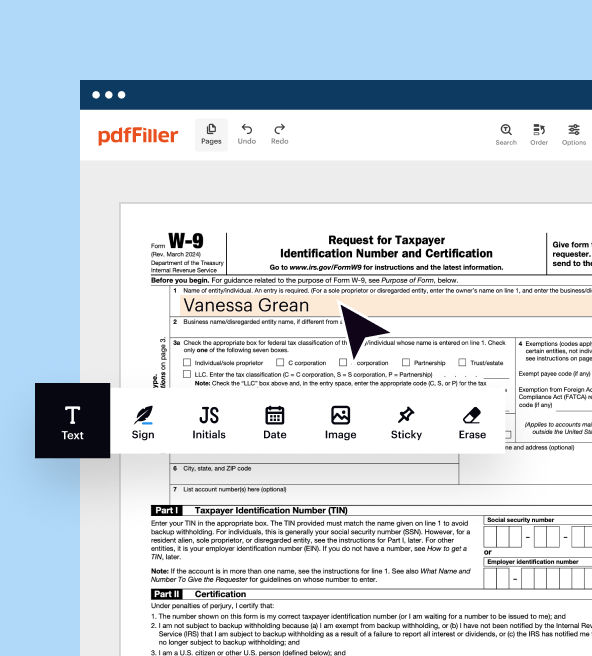

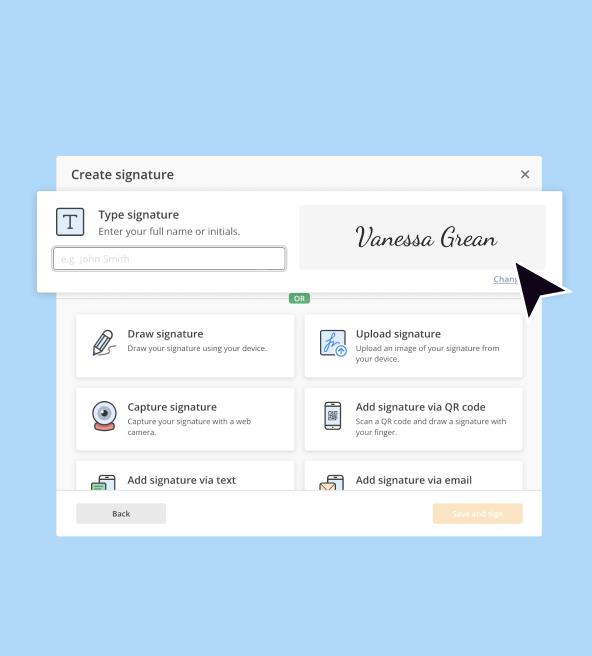

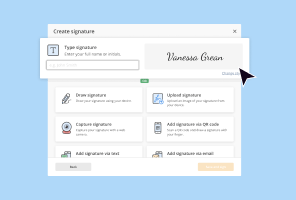

Follow these clear, actionable steps to edit IRS CP565 effectively:

01

Review your completed form for accuracy, ensuring every entry matches your financial records.

02

Check for any missing information or signatures required before submission.

03

Utilize a reliable PDF editor or IRS-approved software to make the necessary changes.

04

Save the edited form, retaining a copy for your records.

05

Final review and ensure the updated form meets IRS standards before filing.

Guidelines for Completing IRS CP565

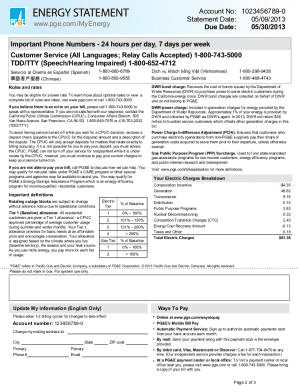

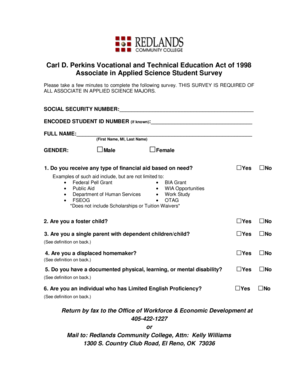

Completing IRS CP565 involves several key components:

01

Provide your personal information accurately, including your Social Security Number (SSN) or Employer Identification Number (EIN).

02

Clearly indicate the tax year for which you are submitting the form.

03

Detail the specific transactions or events your report pertains to.

04

Include any relevant supporting documentation, such as receipts or bank statements.

Show more

Show less

Recent Updates and Modifications to IRS CP565

Recent Updates and Modifications to IRS CP565

Tax regulations are changing, and the IRS CP565 has seen some significant updates:

01

The income threshold for exemption has increased, impacting eligibility.

02

Revisions in reporting requirements now necessitate clearer details for certain transactions.

03

New guidelines for electronic submissions streamline the filing process for taxpayers.

Essential Insights into IRS CP565: Purpose and Usage

Defining IRS CP565

The Functionality of IRS CP565

Who Needs to File IRS CP565?

Exemption Criteria for IRS CP565

Components of IRS CP565

Filing Deadline for IRS CP565

Comparison with Related Forms

Transactions Covered by IRS CP565

Copies Required for IRS CP565 Submission

Punitive Consequences for Non-compliance with IRS CP565

Information Necessary for Filing IRS CP565

Companion Forms to IRS CP565

Where to Submit IRS CP565

Essential Insights into IRS CP565: Purpose and Usage

Defining IRS CP565

IRS CP565 is a notification sent by the IRS to inform taxpayers about the requirement to report specific financial transactions. Understanding the conditions under which this notice is sent is vital for proper compliance.

The Functionality of IRS CP565

This form serves to ensure that taxpayers disclose information on specific occurrences, such as certain transactions or potential tax liabilities, thereby maintaining transparency in their financial activities.

Who Needs to File IRS CP565?

This form is typically required for taxpayers engaged in particular transactions such as:

01

Businesses exceeding designated income thresholds.

02

Taxpayers involved in sales of property that meet IRS regulations.

03

Individuals or businesses in specific industries such as finance or real estate.

Exemption Criteria for IRS CP565

Exemptions from filing IRS CP565 can apply in several scenarios. Here are qualifying conditions:

01

Annual income below a specific threshold (e.g., single filers earning less than $12,400).

02

Certain non-profit organizations that do not engage in taxable transactions.

03

Transaction types, such as those falling under specific IRS sections that do not require reporting.

Components of IRS CP565

The form comprises various parts, including:

01

Identification details of the taxpayer.

02

Nature of the reported transaction.

03

Details of other income or relevant tax liabilities.

Filing Deadline for IRS CP565

To avoid penalties, IRS CP565 must be filed by the tax return due date, generally April 15 for individual taxpayers. Business deadlines may vary based on the type of entity but typically align with March 15 or similar dates.

Comparison with Related Forms

Comparatively, IRS CP565 serves a more specific purpose than General IRS forms like 1099 or W-2, which report various income kinds. While 1099 addresses miscellaneous income, CP565 uniquely pertains to particular financial transactions, highlighting its specialized nature.

Transactions Covered by IRS CP565

Specific transactions necessitating IRS CP565 may include:

01

Sales of capital assets exceeding a set amount.

02

Real estate transactions requiring detailed financial reporting.

03

Complex investment dealings as triggered by certain limits.

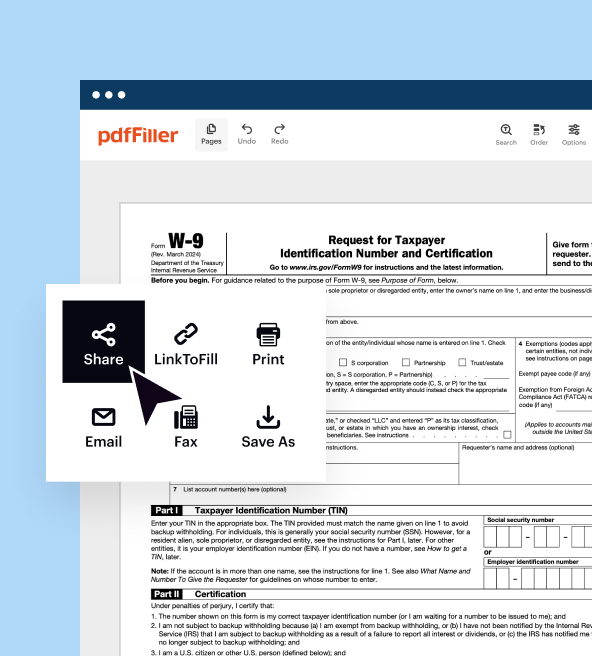

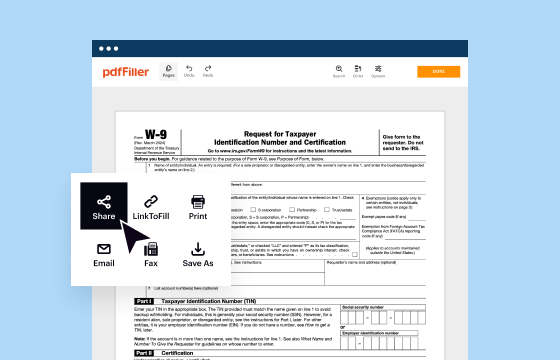

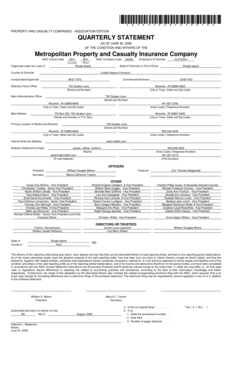

Copies Required for IRS CP565 Submission

When submitting IRS CP565, typically, only one copy is required for mail submissions. However, if filing electronically, ensure that the IRS platform confirms receipt of your submission.

Punitive Consequences for Non-compliance with IRS CP565

Failure to submit IRS CP565 can lead to a range of penalties, including:

01

Small fines for minor discrepancies or late submissions (e.g., $50 per instance).

02

Substantial fines for continuous non-compliance, potentially exceeding $500.

03

Legal actions for willful tax evasion or significant reporting errors.

Information Necessary for Filing IRS CP565

Before filing, gather essential information such as:

01

Your SSN or EIN for identification purposes.

02

Details of the financial transaction being reported.

03

Any supporting documentation backing claimed exemptions or reporting.

Companion Forms to IRS CP565

When filing IRS CP565, you may need to file accompanying forms. Common examples include:

01

Schedule D if applicable for capital gains or losses.

02

Form 8949 for reporting sales and other dispositions of capital assets.

Where to Submit IRS CP565

IRS CP565 can be physically mailed to the designated address mentioned in the form instructions. For electronic submissions, use the IRS e-file system to ensure proper filing and tracking.

Understanding IRS CP565 is essential for compliance and effective tax management. By following the outlined guidelines and ensuring all required information is complete, you can navigate your tax responsibilities smoothly. For further assistance or to start working with IRS CP565, consider contacting tax professionals or leveraging resources like pdfFiller to streamline your form submissions.

Show more

Show less

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

PDF filler is incredibly fast, easy to use and well thought out. This program saves me time and money

Easiest program EVER! Beware you must pay when done

Try Risk Free

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.